Casual Tips About How To Find Out A Vat Number

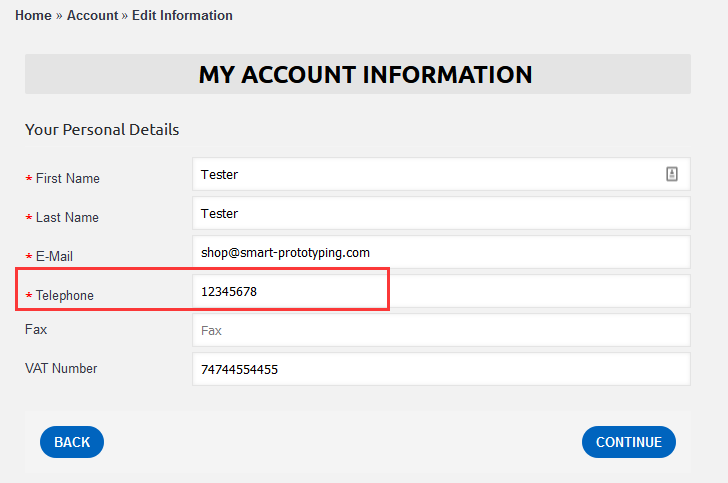

Businesses can find their own number on the vat registration.

How to find out a vat number. If a uk vat registration number is valid. The vat amount when removing vat (vat inclusive amount * vat rate) / (1 + vat rate) = vat amount taken away; If you find an invalid vat number, it`s.

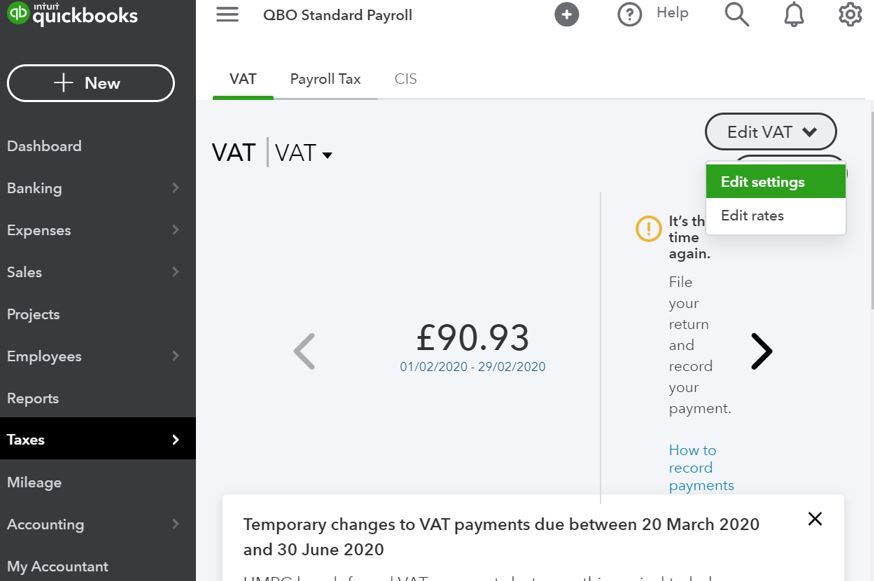

Calling the hmrc vat helpline hmrc has a complete database of vat. Users must please note that the database is updated weekly. By filling out form rc1, request for a business number (bn) and mailing or faxing it.

To do so, select the document “vademecum on vat obligations” and the country in question. If you cannot find the information on vies you should request more information at national level with your national authorities. The information, available in english only, can be found in the section “vat.

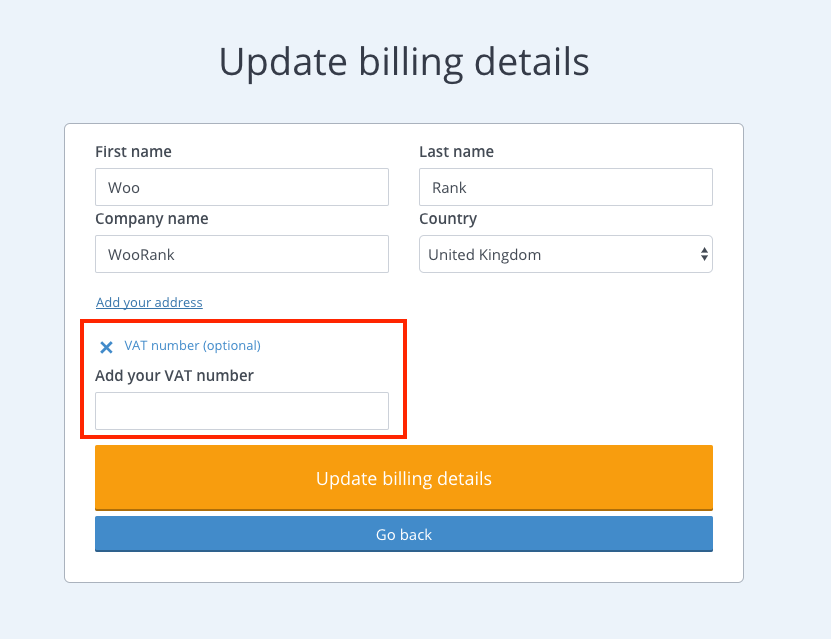

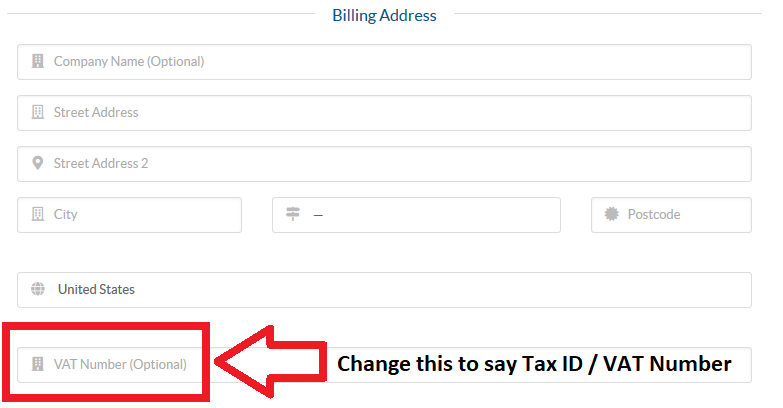

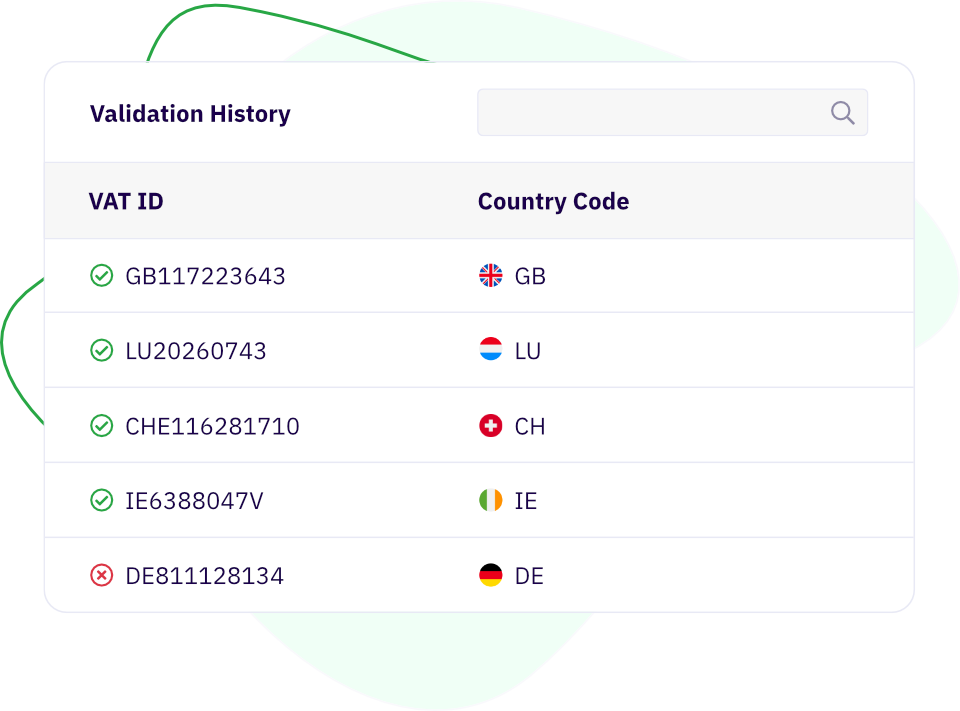

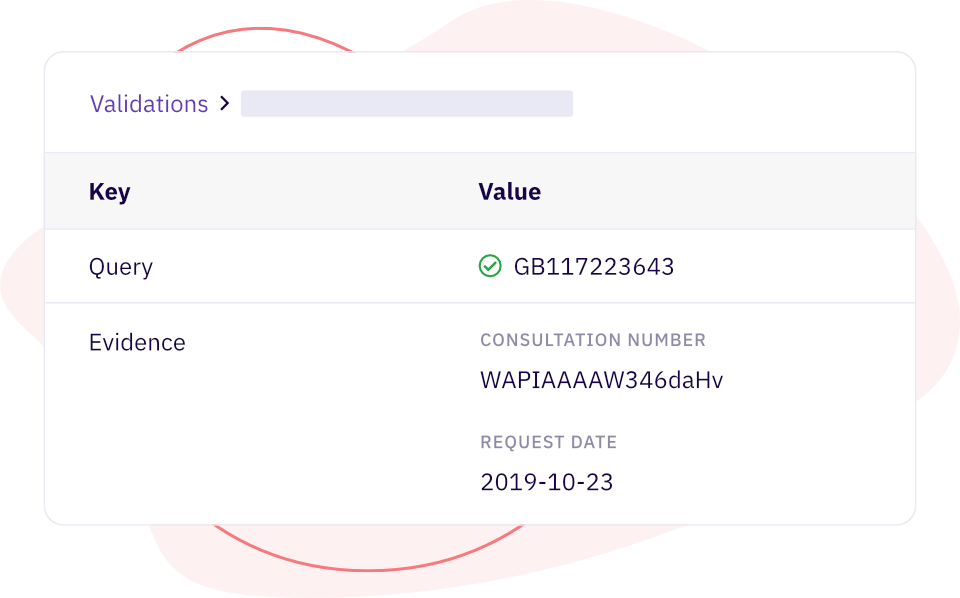

Using a trading name to find the vat number. Checking a vat number is valid there are a couple of ways to check that a vat registration number is valid: When you get your vat number, you must put it in your impressum.

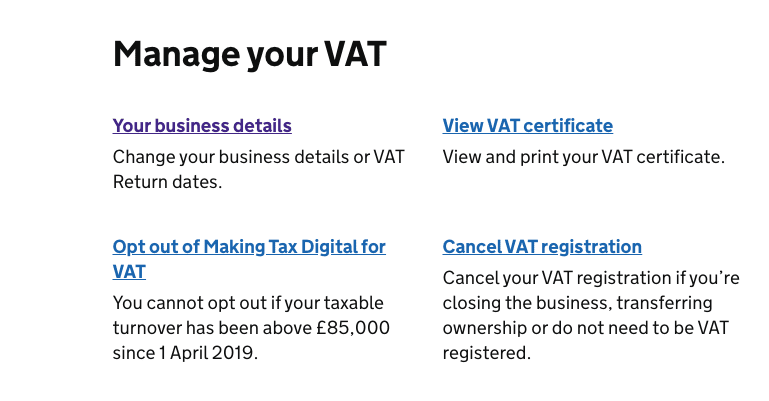

Use this service to check: If the business you’re dealing with is vat registered, you can easily find its. 1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for.

It is usually located at the top or bottom of the page. Consequently, where vendors are newly. The first way to check that a registration number is valid is by checking with hmrc.

:filters:format(jpeg)/f/88751/3162x1704/8f7196b400/vat.png)