Underrated Ideas Of Info About How To Become Tax Advisor

You will become a trainee within the organisation.

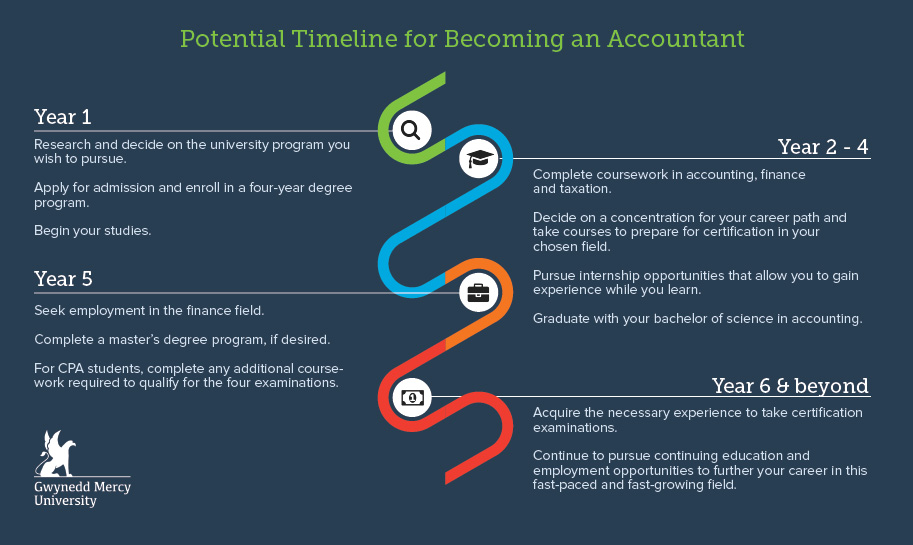

How to become tax advisor. While the specifics will vary based on your background and personal journey, here are the primary steps you can take to become a tax advisor: A certified tax advisor, cta, is a designation awarded to individual educators who have: Upon qualifying, you can apply to become a member of the chartered institute of taxation and become a chartered tax adviser.

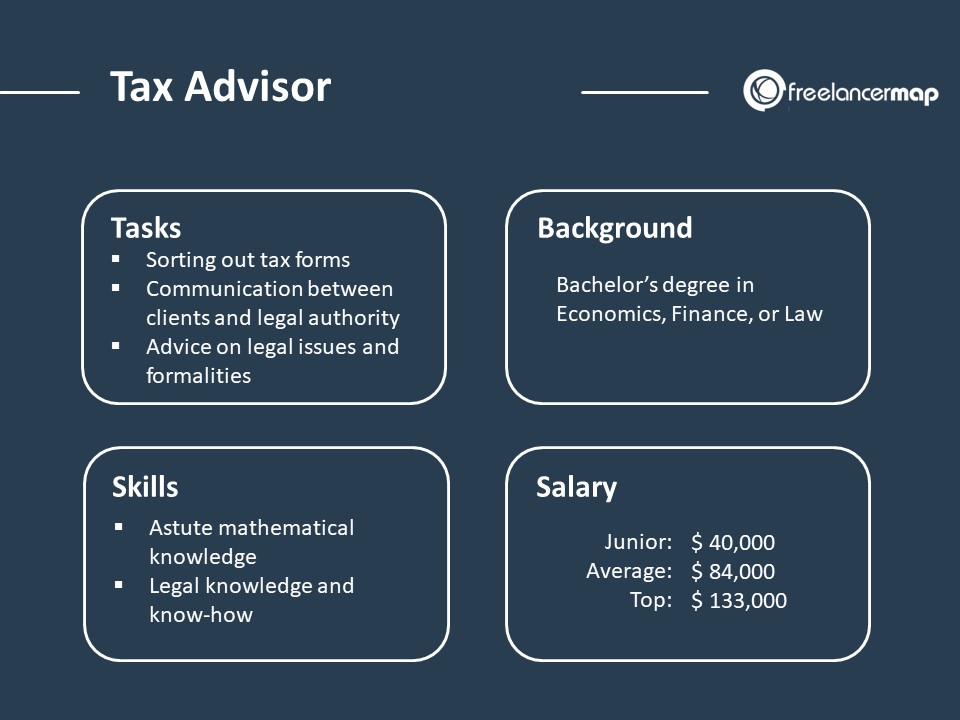

Candidates for the ata must be at least 18 years of age and must. As a quickbooks certified proadvisor, you’ll earn points and rewards to grow your firm and lift your clients. A tax advisor, also known as an enrolled tax agent or certified public accountant, is an accounting professional who specializes in the complex u.s.

Then, you need to become certified through your state’s accountancy board. If you're interested in becoming a master tax advisor, one of the first things to consider is how much education you need. A corporate tax advisor, who sometimes works as an employee of the organization he or she is advising, must have extensive knowledge of corporate tax codes and regulations.

How do you become a tax adviser in the uk? We've determined that 58.5% of master tax. To become an ata, you must pass the ata examination which is offered twice a year at testing centers around the country.

Research the industry and career. The tax consulting profession does not include any specific educational requirements. For most, entry is via a degree and then recruitment by organisations such as accountancy firms.

A tax advisor analyses and extract the. Make sure you have right skills for tax advisor. Maintained good standing with all.

![How To Become A Tax Consultant [Education Requirements & More]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1174262745.jpg)

![Tax Consultant & Specialist Job Description [Career Overview]](https://www.accounting.com/app/uploads/2020/10/GettyImages-1168618923.jpg)